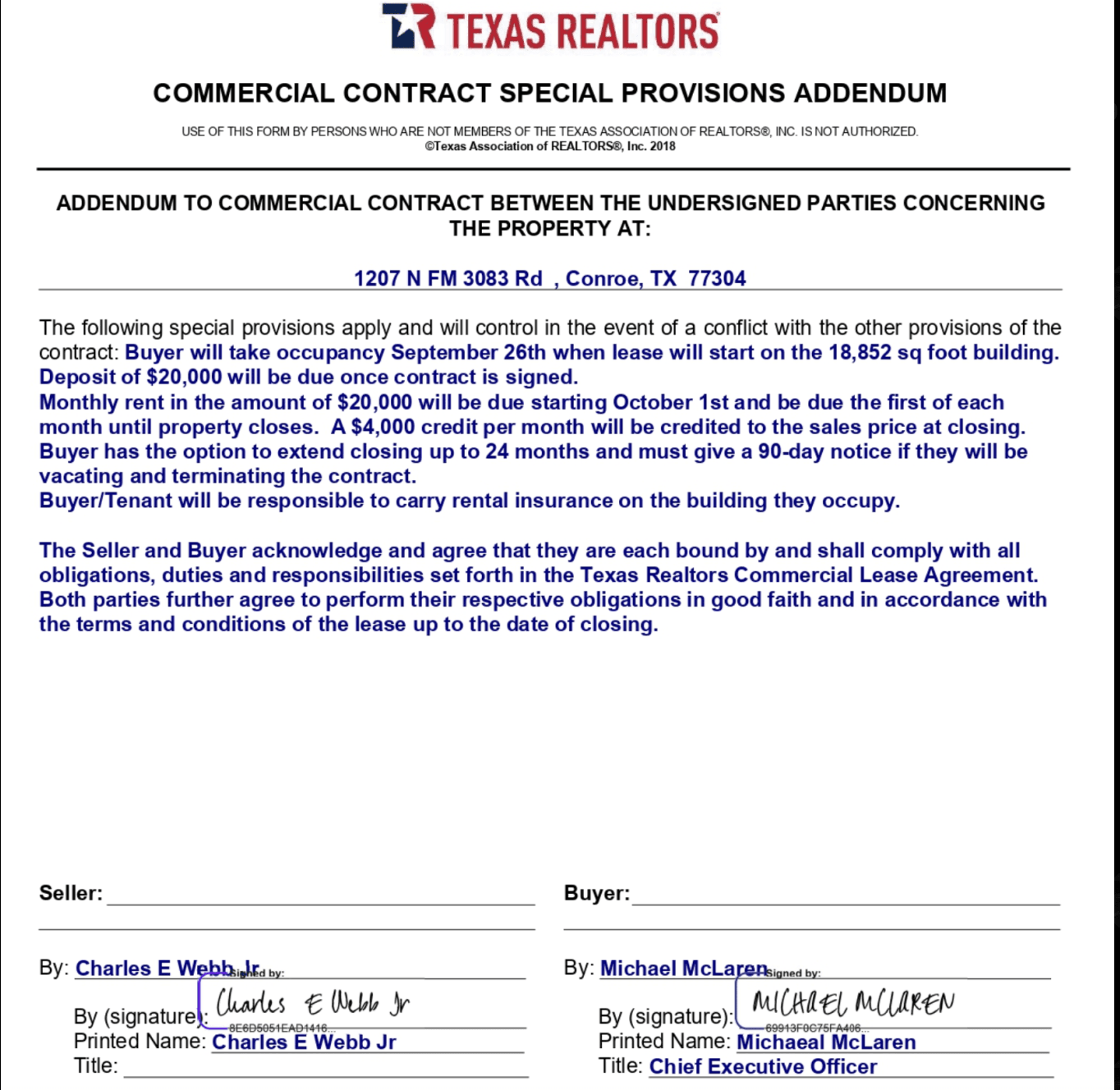

SGBX Deep Dive: Float, Short Interest & Squeeze Potential

Published: December 7, 2025 • By: MoomooStocker

Edited By: TMG

TL;DR

- •Verified maximum float: ~1.42M shares

- •Current short interest: 933,339 shares (~65% of float)

- •Discord retail group: 581,170 shares (184 members verified)

- •32 consecutive days on NASDAQ SHO FTD list (SMX had only 8)

- •CTB consistently 300%–470% for weeks

- •Dilution vote Dec 29 = ~3-week squeeze window

📊 Float Breakdown

| Category | Shares |

|---|---|

| Shares Outstanding | 5,688,555 |

| Common Shares to be Registered | 937,500 |

| Pre-Split Common Shares | 483,167 |

| Total Maximum Tradable Float | 1,420,617 |

🎯 Short Interest Analysis

For context: AMC squeezed at 20–24% SI. SGBX is currently at ~65% with a micro-float.

📈 Previous Squeeze Comparisons

| Stock | SI at Start | Float Size | Start Price | Peak Price | Days on FTD |

|---|---|---|---|---|---|

| AMC (2021) | 20–24% | 501.8M | $10.81 | $72.62 | 0 |

| GME (2020–21) | 141% | 400–500M | $17.25 | $483.00 | 0 |

| SMX (Recent) | 21.7% | 830k | $1.04 | $490.00 | 8 |

| SGBX (Now) | 65% | 1.42M | $3.81 | ? | 32 |

💰 Cost to Borrow (CTB)

SGBX has maintained consistently high CTB rates between 300%–470% for weeks, indicating extreme difficulty for shorts to maintain positions.

🔥 Float Math Summary

Negative float indicates more shares claimed than should exist in the tradable supply.

⚠️ FTD Exposure (Dec 15+)

Two massive short-volume days are expected to appear in the December 15+ FTD update:

If accurate, this will expose a major synthetic share issue.

📅 Critical Timeline

🎢 Low Float Behavior

On December 5, 2025, after-hours trading demonstrated extreme low-float characteristics:

This type of price action is consistent with an extremely illiquid, low-float environment.

💭 Final Thoughts

Being early in AMC, GME, HKD, or SMX would have been ideal. SGBX shows several of the same early indicators right now:

- ✓High short interest (~65%)

- ✓Effectively zero share availability

- ✓Rising CTB (300%–470%)

- ✓32 consecutive days on FTD list

- ✓Strong verified retail ownership

- ✓Negative calculated float

More updates will be added as additional data becomes available. This analysis is updated daily.

Disclaimer: This analysis is for informational and educational purposes only and does not constitute investment advice. All data is sourced from publicly available filings and third-party data providers. Past performance of similar securities is not indicative of future results. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions. Trading stocks, especially those with high volatility and low float, carries significant risk of loss.